Few nations are as concerned about growing prices as Germany.

A century ago, the nation was ravaged by hyperinflation, which devastated the economy and filled generations of schoolchildren’s history textbooks with images of destitute citizens transporting wheelbarrows full of currency and using banknotes as kindling.

As a result, it is not surprising that the recession-stricken nation felt a chill this week when data revealed an unexpectedly significant increase in inflation from 6.3% to 6.8% in June.

As surveys indicate a decline in business confidence and economists prepare for additional interest rate hikes from the European Central Bank (ECB), there are mounting concerns that the inflation crisis sending shockwaves through London will soon reach Berlin.

According to Jack Allen-Reynolds of Capital Economics, “I am not optimistic about Germany.”

The substantial tightening of monetary policy will have the greatest impact on the economy in the near future.

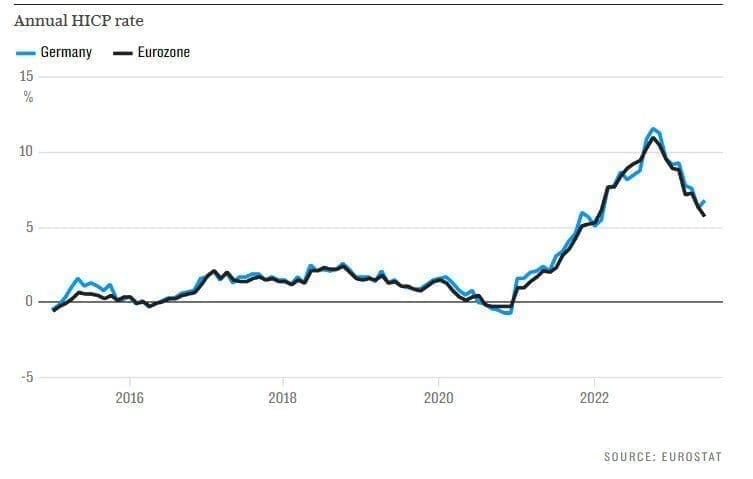

According to Eurostat data, German inflation crested at 11.6%, higher than Britain’s 11.1% and worse than the eurozone average of 10.6%.

In spite of the easing of the energy crisis and food price pressure in the aftermath of Russia’s invasion of Ukraine, the country is still struggling to maintain cost control.

The inflation rate is considerably above the eurozone average of 5.5%.

Services inflation, which is a solid indicator of domestic price pressures because it excludes imported costs, increased from 4.4% to 6.1%.

This is partially due to the fact that a generously subsidized rail program suppressed prices last summer, and its absence this year is reflected in a price increase.

However, price increases for services have also accelerated since last summer, highlighting the possibility that inflation will become embedded in the economy.

This is a risk in many nations, as a series of economic shocks has pushed up the prices of energy and products, which then spread to other industries and wages, increasing the likelihood of a cycle of sustained inflation.

For example, services inflation in the United Kingdom reached 7.4% last month.

However, Germany’s situation is significantly worse.

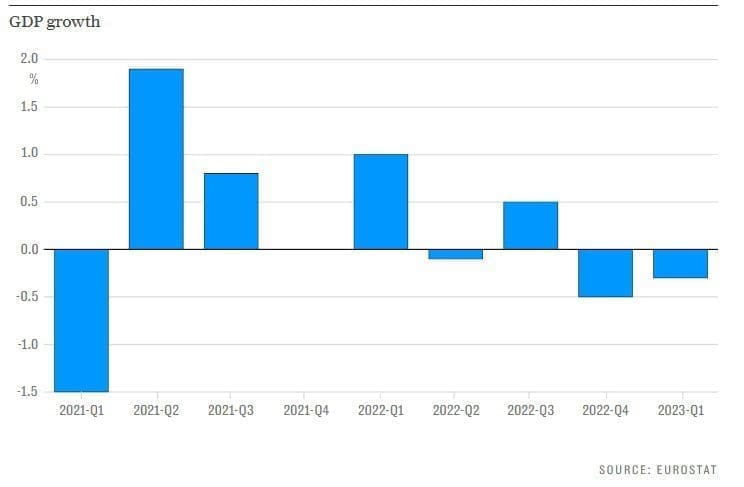

The largest economy in Europe is in recession, whereas the United Kingdom has shown a little more resilience by maintaining growth despite the overwhelming pressure of the cost of living crisis.

German GDP is 0.5 percentage points below its pre-Covid level, putting it on par with Britain’s poor performance, but in the wrong direction as Britain weathers the tempest.

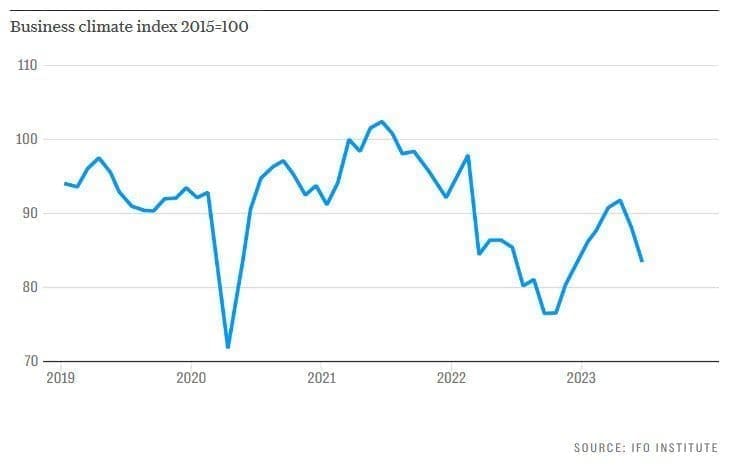

While household and business confidence in the British economy appears to be stabilizing or recovering despite rising interest rates, the opposite is true in Germany, which portends poorly for the remainder of the year.

The Ifo Institute’s indicator of business expectations and the broader business climate are falling.

The outlooks for the manufacturing, trade, and construction industries are all deteriorating, whereas the services sector, once a bright point in the post-Covid recovery, is now stagnant.

The vital industrial sector has been hit particularly hard by the series of shocks in recent years, including pandemic disruptions to supply chains, China’s protracted lockdowns, and the energy crisis, due to the country’s reliance on Russian oil and gas.

According to Mateusz Urban of Oxford Economics, the decline in energy prices relieved pressure on German factories, only for companies to discover that the export demand on which they relied was absent.

“The German economy is struggling primarily due to a decline in foreign demand,” he says.

“The Chinese reopening has not yet delivered the upward force and support that most people had anticipated,” with Beijing’s authorities providing insufficient stimulus.

Europe’s consumers are spending more money on services, especially vacations, than on products, a trend that benefits the continent’s sunny south more than German industry.

The nation’s long-term fundamentals are threatened by technological advances – its automakers have been sluggish to transition to electric vehicles – as well as climate change, which threatens its reliance on fossil fuels, and demographic shifts.

Jens Eisenschmidt, an economist at Morgan Stanley, asserts that the German economy relies on a large influx of migrants to compensate for its shrinking labor force; however, inflows are declining, which threatens its development prospects.

According to his analysis, “the underlying trend of steady migration is slowing, and intra-EU migration is actually reversing.”

“Additionally, refugees do not necessarily (immediately) contribute to Germany’s labor force in the same manner that non-humanitarian migrants do. Therefore, there is a substantial possibility that Germany falls far short of the annual quota of 400 000 migrants.”

In the meantime, Germany’s difficulties contribute to the European Central Bank’s difficulties.

It must set interest rates for the entire currency area with a medium-term goal of 2% inflation.

A one-size-fits-all policy is exceedingly difficult to implement when Spain’s prices are increasing by only 1.6% while Italy’s inflation rate of 6.7% is close to German levels.

Emily Nichol, an economist at Daiwa Capital Markets, anticipates that the Frankfurt-based ECB will focus on the German data-related concerns despite the general decline in inflation.

“Most importantly for the ECB, due to the large increase in Germany and despite indications of some softening elsewhere in the region, core inflation in the eurozone will likely increase marginally,” she says.

With the base effect expected to keep German services inflation elevated for the next couple of months as well, eurozone core inflation is likely to remain close to 5.5 percent until September, persuading the Governing Council to raise interest rates at each of the next two monetary policy meetings.

These higher interest rates run the danger of spreading Germany’s economic crisis to more of its neighbors, thereby reducing demand for its exports.

Until now, the ECB has increased its headline deposit rate from minus 0.5pc to 3.5pc. In an effort to reduce core inflation, policymakers are likely to raise interest rates in July and September.

Allen-Reynolds states, “The eurozone as a whole is in recession by the narrowest of margins.”

“However, given that we have not yet seen the full effect of ECB tightening that it has already implemented, let alone that which it will implement, it is highly likely that the region as a whole will continue to struggle.”

German nerves may have to endure high inflation and rising interest rates for an extended period of time.