Alibaba Group appointed Brooklyn Nets owner Joe Tsai as its chairman, placing a close ally of fellow co-founder Jack Ma at the helm of the Chinese e-commerce giant as it seeks a turnaround from sluggish growth and intense competition.

According to company insiders and analysts, Tsai, 59, is close to Ma, the company’s largest shareholder who stepped down as executive chairman in 2019 and has maintained a low profile since it appeared he had a dispute with Beijing over a regulatory crackdown on the tech industry.

Their relationship could give Tsai more influence than the departing chairman Daniel Zhang to advance the company’s plans to reorganize into multiple independent companies and revive the development of its e-commerce business.

Eddie Wu, another of Ma’s co-founders, will replace Zhang as chief executive officer. Wu presently oversees the Taobao and Tmall domestic e-commerce business. The modifications will take effect on September 10.

After graduating from Yale, Taiwanese-born and American-educated Tsai was a former attorney and private-equity investor. He co-founded Alibaba with Ma in 1999, served as its CFO, and was promoted to executive vice chairman in 2013. He and Ma are the only permanent members of Alibaba Partnership, the highest-ranking decision-making body for the e-commerce giant’s affiliates.

Tsai’s strong ties to the United States are uncommon among Chinese industry leaders today, although he has been criticized in America for parroting Beijing’s position on certain contentious issues. In 2018, he purchased the Nets basketball franchise. He played high school football at the Lawrenceville School in New Jersey, lacrosse at Yale University, and lacrosse at Yale University. He also controls the professional lacrosse team San Diego Seals and the professional women’s basketball team New York Liberty. His parents qualify him for a passport in Hong Kong and Canada.

The reorganization could maintain Ma’s influence, as he orchestrated the dissolution of the e-commerce empire while he was abroad for the majority of the year preceding the plan’s unveiling. On Saturday, he was in his birthplace of Hangzhou, where Alibaba is headquartered, to attend and converse with the finalists of the annual global mathematics competition he founded in 2018.

Last month, Ma met with executives of Alibaba’s Chinese commerce division to discuss the company’s intensifying competition, according to sources with knowledge of the meeting. According to individuals familiar with the matter, he urged the division to revise its business strategies and governance, stating that Alibaba’s past success strategies may no longer be applicable.

Michael Evans, the president of Alibaba, stated at a technology event in Paris last week that Ma is still the company’s largest shareholder and cares deeply about the business.

The reorganization suggests that Ma is returning “to exercise more direct control,” according to Charlie Chai, a tech-focused analyst at 86Research.

Beijing may welcome Ma’s continued influence, given that Alibaba’s dominance is confronting formidable challenges from competitors and that the company’s revival could help boost the nation’s consumption and accelerate the development of artificial intelligence.

In the early days of Alibaba, Tsai was instrumental in securing investments from Goldman Sachs and SoftBank and building the company’s in-house venture investment team from inception.

According to Vey-Sern Ling, senior adviser for Asia technology equities at Union Bancaire Privée, Tsai’s appointment should be viewed favorably by investors. Ling added that the move is unlikely to improve Alibaba’s stock price, which is ailing due to geopolitical issues and concerns over China’s economy rather than management concerns.

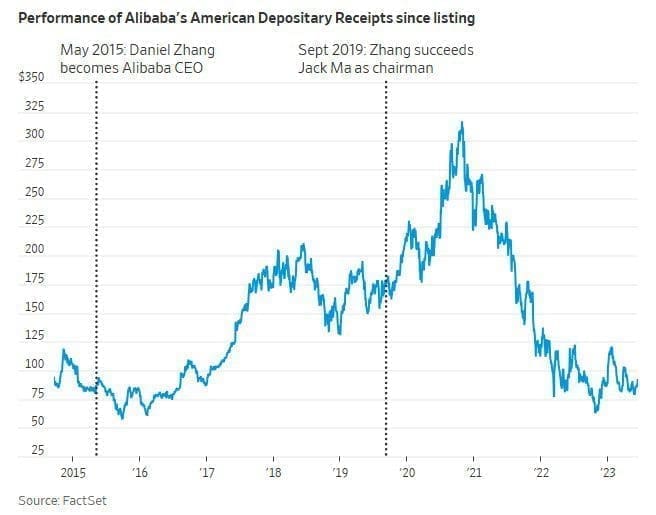

Alibaba’s market capitalization surpassed $850 billion at its peak in late 2020, but had dropped to approximately $238 billion prior to the announcement of the leadership transition. The company’s New York-listed American depositary receipts fell 2% in premarket trading in the United States on Tuesday.

Wu, the incoming CEO of Alibaba, led the company’s strategy to develop and prioritize smartphone shopping sites as consumers transitioned to mobile internet use. A computer science graduate, he was formerly the chief technology officer of multiple Alibaba business entities, including Taobao and the digital payment platform Alipay.

The emergence of Wu, a lower-profile executive at Alibaba, could contribute to the company’s plans to use technology, including artificial intelligence, to revive its stalled e-commerce business, according to people familiar with the plan.

As the group bets on its growth, Zhang will continue to lead Alibaba’s cloud-computing division, the company’s second-largest operation by revenue after its domestic e-commerce division. Alibaba stated in May that it intended to completely spin off the business and conclude its public listing within the next year.

Zhang, a former financial consultant at PricewaterhouseCoopers, joined Alibaba in 2007 to oversee Taobao’s finances and operations and became the group’s chairman in 2019. Senior colleagues referred to him as “a man of action,” but he was less adept at navigating the group’s potent veterans, according to sources familiar with the situation.

Zhang stated in a letter to staff seen by The Wall Street Journal, “My appointment as CEO and chairman of Alibaba Group was beyond my wildest dreams.” He stated that the cloud unit’s spinoff plans are proceeding at maximum speed.

Alibaba’s restructuring is the culmination of a multiyear effort to make the company more agile. The diverse businesses of Alibaba will be divided into six main categories: cloud computing, Chinese e-commerce, global e-commerce, digital mapping and food delivery, logistics, and media and entertainment.

Alibaba has experienced sluggish development as a result of a cooling domestic economy and rising competition from homegrown startups such as PDD Holdings’ Pinduoduo e-commerce platform and ByteDance’s short-video app Douyin.

Alibaba’s revenue growth in the January-March quarter was the lowest since the company went public in 2014.