Iran is shipping more crude oil than it has in nearly five years, bolstering its re-emergence on the geopolitical stage while posing threats to the global crude oil market.

According to a number of analysts, including Kpler Ltd., SVB Energy International, FGE, and the International Energy Agency, exports have reached their greatest level since the US re-imposed sanctions in 2018. The overwhelming majority is flowing to China, as the world’s largest importer buys barrels from the Islamic Republic at discounted prices.

Even though the country is still reeling financially from years of isolation, resurgent sales are the clearest indication yet that it is asserting itself, having begun to repair ties with regional rivals, fostered relations with Asia’s leading power, and even initiated a tentative diplomatic engagement with Washington.

However, the extra supplies are eroding confidence in an oil market weakened by faltering economic growth and inexpensive Russian cargoes, confounding Iran’s OPEC+ allies’ efforts to stabilize crude prices.

According to Homayoun Falakshahi, a senior analyst at Kpler, Iran’s crude oil exports shattered the record last month. Those willing to take the risk to purchase Iranian crude oil will find it to be incredibly appealing.

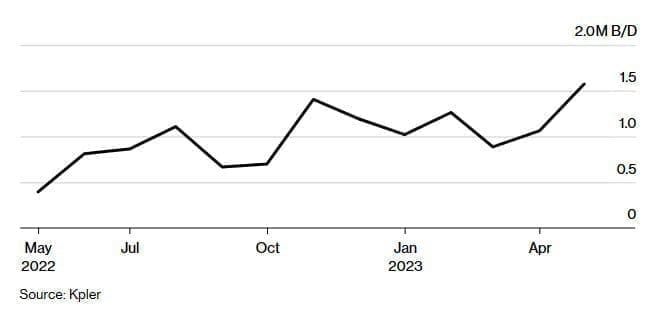

Iran’s Oil Exports Raise to Highest Level Since Sanctions Began

The firm reports that crude oil exports have doubled since last fall, reaching 1,6 million barrels per day in May despite the continuation of American sanctions. IEA estimates that production has reached 2.9 million barrels per day, the greatest level since late 2018. Consultants SVB Energy, Petro-Logistics SA, and FGE estimate that production is even greater, possibly exceeding 3 million barrels per day.

The resumption of inflows, which were severely curtailed after former President Donald Trump withdrew from a nuclear deal with Tehran in 2018, could bolster an economy ravaged by soaring inflation, a depreciating currency, and periodic protests against Iran’s fundamentalist president, Ebrahim Raisi.

It coincides with other indicators of Iran’s revival, including a preliminary agreement with regional adversary Saudi Arabia in April, efforts to rehabilitate Syrian ally Bashar al-Assad, and secret discussions with the White House to reduce tensions.

Through negotiations between intermediaries in Oman and on the sidelines of United Nations meetings, Washington and Tehran are inching toward an agreement to free American prisoners and explore limits on Iranian nuclear research in exchange for the ability to ship more crude, according to a source familiar with the Iranian position.

A State Department official stated that rumors of a nuclear agreement are “false and misleading” and that the United States’ top priority remains preventing Iran from acquiring a nuclear weapon. Iran claims its nuclear program is solely for benign purposes.

Yet additional shipments, in addition to movements from two other sanctioned OPEC+ members, Russia and Venezuela, have already begun to impact global oil markets. Prices have declined by 12 percent this year to near $75 per barrel in London, prompting a spate of downgrades from analysts such as Goldman Sachs Group Inc. and JPMorgan Chase & Co.

Iran’s increase has undermined efforts by the Organization of Petroleum Exporting Countries and its leader, Saudi Arabia, to stabilize the market. Saudi Arabia announced this month a new production cutback of 1 million barrels per day, which had little effect.

Since the reimposition of US sanctions five years ago, Iranian crude has been shipped to its few residual buyers on a so-called “dark fleet” of tankers whose transponders are deactivated to avoid detection.

While tanker surveillance indicates that China has remained Tehran’s largest customer, official data indicates that the Islamic Republic has made no imports in the past year. Instead, purchases have increased from Malaysia, where Iranian cargoes are frequently transferred to other vessels, obscuring the origins of the shipment.

“These ghost barrels are not counted in the official total,” stated Sara Vakhshouri, founder and president of SVB. However, “while the entire OPEC+ is attempting to cut as much as possible and Saudi Arabia is voluntarily cutting,” every barrel counts.

Kpler reports that Chinese refiners, particularly smaller, independent companies in the province of Shandong, are increasing their purchases of Iranian cargoes as price discounts offered by Tehran help to counteract a recent decline in profit margins.

According to Iman Nasseri, managing director at FGE in Dubai, Iran has had to deepen discounts on its petroleum in order to compete with the influx of Russian crude that sanctions have forced out of Europe. According to the companies, the increased flow is consuming a significant amount of the crude oil that had been stored on tankers to meet demand.

“China’s willingness to support Iran by purchasing its sanctioned oil indicates a slight improvement in Iran-China relations,” said Eurasia Group analyst Greg Brew. All of this lends credence to the notion that Iran’s position is strengthening, as is its normalization with other regional states.

Beijing brokered the nascent detente between Iran and Saudi Arabia — a symbol of the growing closeness both countries desire with Asia’s rising power — as the Middle East rivals sought to defuse decades of proxy conflicts, such as Yemen’s ongoing war.

In addition to China’s increased demand, some analysts hypothesize that the US government has tacitly approved the increase in order to keep petroleum prices in check. As the two nations work to establish a diplomatic channel, turning a blind eye could also be advantageous.

According to FGE’s Nasseri, there has been less enforcement of sanctions by a US administration seeking to counter Russian crude on the market while maintaining supply.

The impact of Tehran’s return on oil prices may be limited going forward. While authorities undertake a crackdown on bitumen mixture, which traders suspect is a cover for denser and cheaper barrels sold by Iran, crude shipments to China may slow.

Regardless, the IEA forecasts that global oil markets will experience a significant deficit for the remainder of the year as China’s post-pandemic recovery gains momentum. In the second half of the year, demand will exceed supply by approximately 2 million barrels per day, more than enough to accommodate additional Iranian flows.

Crude oil traders continue to harbor skepticism regarding the anticipated supply tightening, in part due to Iran’s escalating barrel production, which casts a shadow on the outlook.

“Negative supply side anxiety is palpably shaping the mood,” said Tamas Varga, an analyst at London-based broker PVM Oil Associates Ltd., adding that additional Iranian flows contribute to this.