The Federal Reserve’s decision to maintain current interest rates while predicting additional rate hikes in the future reflected a compromise that makes a rate increase next month more likely, analysts said after Federal Reserve Chair Jerome Powell’s remarks on Wednesday.

Some said that Powell’s language during a press conference suggested that his current default position is to raise interest rates at the Fed’s meeting on 25-26 July.

12 of 18 Fed officials, according to new economic projections released on Wednesday, expect to raise rates at least twice more this year to combat inflation, up from four officials in March.

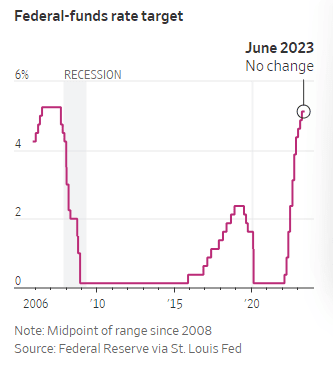

Wednesday, officials unanimously resolved to maintain the present range of the federal funds rate between 5% and 5.25 percent. Another increase would bring the short-term rate to its highest level in 22 years.

Policymakers are concerned that inflation and economic activity have not slowed more significantly. They are attempting to strike a balance between this and the possibility that the delayed effects of their rapid increases last year and more recent financial strains could impede growth and the labour market more than anticipated in the coming year.

After holding the fed-funds rate near zero in the aftermath of the Covid-19 pandemic, the Fed has raised the rate by a cumulative 5 percentage points at 10 consecutive meetings since March 2022, the most rapid sequence of increases since the 1980s.

This year, officials slowed their increases. At each of their first three meetings of 2023, most recently in May, they raised the rate by a quarter percentage point. Powell stated that Wednesday’s decision not to raise interest rates “continues this process.”

In 2017 and 2018, Powell’s first year as Fed chair, the Fed increased interest rates at every other meeting, or once every three months. This slightly delayed pace “provides us with more information…to make better decisions.” It gives the economy a bit more time to adjust,” he stated on Wednesday.

Powell stated repeatedly that Fed officials have not determined whether to raise interest rates in July, but at one point he referred to Wednesday’s decision to maintain the status quo as “the skip.”

Several analysts believe that he inadvertently disclosed his intention to raise interest rates next month.

Powell stated, “We’re trying to get this right, and if you consider [the speed and the level of rate increases] as separate variables, then I believe the decision to’skip’—I shouldn’t say’skip’—makes sense.”

Powell also referred to the July meeting as “live,” a term officials frequently employ to indicate that a rate hike is more likely than not.

Gregory Daco, chief economist at consulting firm EY, said, “His slip-of-the-tongue reference to a’skip’ indicates that a rate hike in July is nearly assured, and it likely explains how Powell managed to secure a unanimous vote in favour of a hold despite differing policymaker opinions.”

Other analysts stated that upcoming economic readings are unlikely to indicate sufficient weakness prior to the Fed’s meeting next month to prevent a rate hike. Before their next meeting, officials will receive reports on monthly payroll employment and inflation, as well as quarterly bank earnings.

Tim Duy, chief economist at SGH Macro Advisors, opined that a single month of improvement would not suffice to justify a prolonged halt in rate hikes, despite the fact that a number of economists expect inflation to have declined in June due to recent declines in used car prices.

Powell stated that officials had not yet decided to move to an every-other-meeting schedule of rate hikes, but he also stated that he favoured separating out the Fed’s rate hikes given how much closer they are to their desired rate level.

Duy stated, “There is an every-other-meeting strategy, and the July decision is nearly finalised.”

During Powell’s press conference, investors on interest-rate futures markets reduced their wagers on a rate hike in July. According to CME Group, market-implied probabilities of a July rate hike soared from around 65% to 90% after the Fed’s policy statement and officials’ rate projections were released on Wednesday afternoon, but they retreated to around 65% after Powell’s news conference.

Powell sounded both optimistic and forthright about the difficulty of bringing inflation back to the Fed’s 2% target. “The process of bringing inflation down will be gradual,” he stated. Simultaneously, “the conditions we need to see in place to reduce inflation are materialising.”