The origin of the industrial revolution requires innovation desperately. In the way are Britain’s mortgage-heavy institutions.

The United Kingdom, inventor of the factory system, steam engine, and passenger rail, is at the forefront of a global productivity decline in the twenty-first century. Since the financial crisis, growth in U.K. productivity, or production per hour worked, has halved, prompting some policymakers to refer to this era as Britain’s lost decade. Only Italy has performed worse among the seven largest developed economies in the globe.

The debated causes include an aging population, stricter regulations, and the United Kingdom’s exit from the European Union. A factor that has garnered particular attention, however, is the manner in which U.K. banks have skewed lending toward the booming housing market.

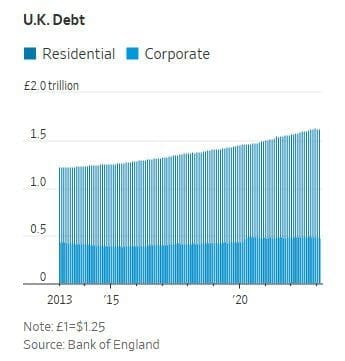

The bank lending for initiatives that increase economic output, such as equipment and software, has stalled. According to studies and regulators, the two phenomena are related: As real estate prices rose, banks shifted more capital into housing, which was deemed less hazardous because the loans were collateralized by tangible assets with appreciating values.

“The banking system is becoming a greater drag on the economy,” said Jonathan Haskel, a member of the Monetary Policy Committee of the Bank of England.

The United Kingdom is an extreme example of what has occurred in major economies throughout the globe for the majority of this century. In the 2010s and early 2022, central banks will reduce interest rates to make it affordable for businesses to borrow and invest. However, while debt grew rapidly, the majority of it went toward real estate.

According to a report by the McKinsey Global Institute, the world’s total assets, including those held by households, businesses, and institutions, tripled between 2000 and 2020. According to McKinsey, two-thirds are held in real estate, while only one-fifth are in productivity-enhancing assets such as factories, equipment, and infrastructure. The historical correlation between the growth of net worth and GDP is no longer valid, according to the report.

The United Kingdom is tied with France for having the lowest proportion of net worth in assets that stimulate economic development among the world’s 10 largest economies. Meanwhile, property values and mortgage debt in the United Kingdom have exploded.

According to data from the Bank of England, U.K. banks increased mortgage lending by £400 billion, or about $500 billion, over the past decade through February. The quantity of debt extended to businesses increased by only one-tenth as much.

Richard Davies, a former regional director for Barclays’s U.K. business banking operations who now leads Allica Bank, a London startup that lends to small and midsize businesses, stated that the U.K.’s major banks “pulled back during the financial crisis and never really came back” in terms of business lending. The major banks are fixated on residential mortgages.

The preoccupation with mortgages marginalizes some enterprises.

Geometric Manufacturing manufactures defense and surveillance products in Tewkesbury, England. Managing Director Paul Wenham stated that the company requested a loan from a U.K. bank to design and manufacture a robotic arm to load its machines, an investment that would enable the factory to produce more with fewer employees.

Wenham stated that despite the availability of a government guarantee through a U.K. program designed to assist small enterprises, the bank declined to participate. A London-based startup funder ultimately provided the business with a modest loan. The loan had a high interest rate and was significantly lesser than what the business had requested.

Wenham stated that his inability to obtain a larger loan extended the duration of the undertaking by several years. We could have reaped the benefits and rewards so much sooner, said Wenham.

Dozens of new lenders have emerged to cover the void left by the contraction of large banks. According to government data, they provided roughly half of all new loans to small and medium-sized enterprises last year. However, they impose high interest rates on business loans, according to Mike Conroy, director of commercial finance at UK Finance, the principal trade association for the banking industry.

Conroy stated that a dearth of demand, as opposed to a lack of supply, is the primary reason for sluggish business investment. He stated that many entrepreneurs are unwilling to incur debt or have no desire for growth. “Many small businesses in the United Kingdom contribute significantly to the economy and local communities, despite not aspiring to become the next Microsoft or Google,” Conroy said.

According to research conducted in the United States and Australia, banks respond to increasing home values by shifting capital away from businesses. According to a 2018 study published in the Review of Financial Studies, U.S. banks in regions with robust housing markets during the early 2000s inflation increased mortgage lending while decreasing business lending.

In the United Kingdom, regulations enacted after the financial crisis require banks to maintain greater capital reserves for business loans, which are considered riskier than mortgages.

Matt Hammerstein, chief executive officer of Barclays’ U.K. operations, stated that banks increasingly require all borrowers, whether homeowners or businesses, to pledge tangible assets that the lenders could sell if the borrowers default. According to him, many business owners decline to use their assets, such as their homes, as collateral and are therefore denied loans.

“What banks have done over time to bolster their risk appetite is to expect entrepreneurs to risk more of their own capital,” Hammerstein explained. If you’re lending money to a small business, especially one with intangible assets, you’ll need collateral.

About one in fifty established small and midsize enterprises will default in a given year, according to Allica Bank’s Davies. But determining each company’s risk — and consequently what interest rate to charge and how much capital to hold — is less accurate and more time-consuming for large banks, which have shifted their focus to mortgages.

In 2018, Jurga Zilinskiene desired funding to develop software for the expansion of her Guildhawk language-translation business in London. The 40-person company translates documents for international businesses.

She requested a seven-figure loan from a major U.K. bank, but they only granted her a fraction of that amount, citing her absence of tangible assets that could serve as collateral in the event of default. Many of her assets, such as intellectual property, are intangible.

She is concerned that institutions are too focused on short-term profits rather than the economy’s long-term health. She asks, “How can I compete with multinational corporations in the United States and China?”