In an effort to expand its business in Europe, crypto titan Binance established a regional headquarters in Paris last year. Things have not gone as planned.

The Netherlands and Belgium have closed the exchange’s doors. The largest economy in Europe, Germany, has not yet granted it a license to operate. In addition, French prosecutors recently conducted a search of the office of the exchange as part of an investigation into money laundering controls.

According to research firm Kaiko, Binance’s proportion of euro-denominated crypto trading has decreased to approximately 15% from over 30% in January.

Following the failure of FTX, regulators have shifted gears this year, placing greater scrutiny on the operations of cryptocurrency exchanges.

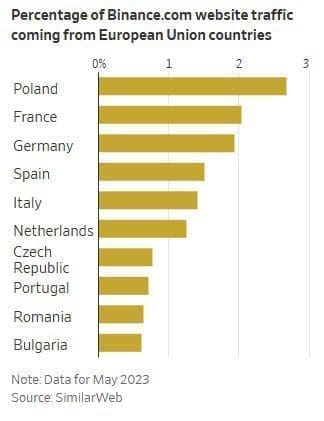

European regulators’ tougher stance threatens to further limit Binance’s footprint and compel it to rely more on markets in Asia, Africa, and Latin America. According to May data from analytics firm SimilarWeb, Vietnam, Turkey, India, and Argentina already attract the most Binance users, although France, Germany, and the Netherlands are among the top 25.

The setbacks compound Binance’s difficulties in the United States, where it is confronting a lawsuit from the Securities and Exchange Commission and an ongoing criminal investigation by the Department of Justice.

A Binance spokesman stated that the company is focused on complying with the requirements of a new European Union law that will regulate digital-asset companies across the bloc’s 27 member states beginning in the coming year. Until then, he stated, “we continue to work to proactively comply with our requirements.”

MiCA is the name of the new EU legislation that will enable companies authorized in one member state to offer services in all other member states. However, there are provisions for countries to ban crypto businesses if their regulators perceive a risk to their consumers, according to Chainalysis spokesman Trenton Kennedy.

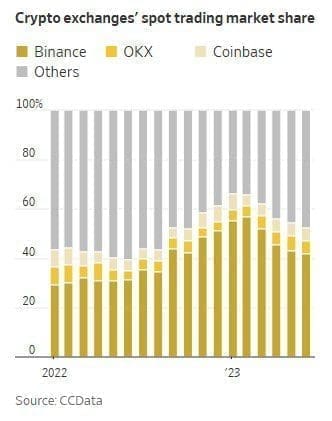

Binance remains the world’s largest cryptocurrency exchange by a wide margin, but its troubles are exacting a toll. According to data provider CCData, Binance’s global market share for spot trading dropped to 42% in June, its fourth consecutive month of declines since reaching a high of 57% in February. The exchange attributed the loss to the termination of its zero-fee bitcoin trading.

Binance was founded by Changpeng Zhao in 2017, while the majority of global regulators remained on the periphery.

When numerous nations began to issue warnings against Binance, Zhao swore to acquire licenses and embrace regulation. Binance established its first regional headquarters in Paris in May 2022, after spending more than a year and a half obtaining registration approval in France.

“Having a G-7 country with a strict regulator sends a very strong signal to other countries,” Zhao said in an interview with The Wall Street Journal at the time.

However, Binance’s reckless past continues to plague it.

According to a statement from the Paris prosecutor’s office, French prosecutors are investigating the exchange for lack of money laundering controls and the unlawful offering of services before Binance received registration. During the search, investigators seized documents and electronic devices, the report added.

A spokesperson for Binance verified that authorities visited the Paris office, but declined to comment on “the specifics of law enforcement or regulatory investigations.”

The Financial Services and Market Authority of Belgium ordered Binance to cease offering services in the country last month, citing the exchange’s illegal use of entities outside the European Economic Area. A few days earlier, Binance announced that it was abandoning the Dutch market because it was unable to obtain registration.

Additionally, the exchange has struggled to obtain approval to operate in Germany, where BaFin, the markets regulator, issues crypto-custody licenses.

“We continue to work to comply with BaFin’s requirements,” said a spokesperson for Binance.

The BaFin license is presently held by seven entities, including the American cryptocurrency exchange Coinbase.

Some banks and other companies that provide financial services for the exchange are alarmed by the increased regulatory scrutiny in the U.S. and abroad.

Paysafe, which facilitates euro transfers to and from Binance, announced last week that it would discontinue the service. It follows an earlier decision to discontinue pound sterling services.

Binance will locate a new provider so it can restart the service, according to a spokesperson.