Apple on Friday became the world’s first corporation to conclude with a market value of more than $3 trillion, a milestone that reflects the enduring influence and resilience of the iPhone, a singular product that continues to revolutionize life and business around the globe.

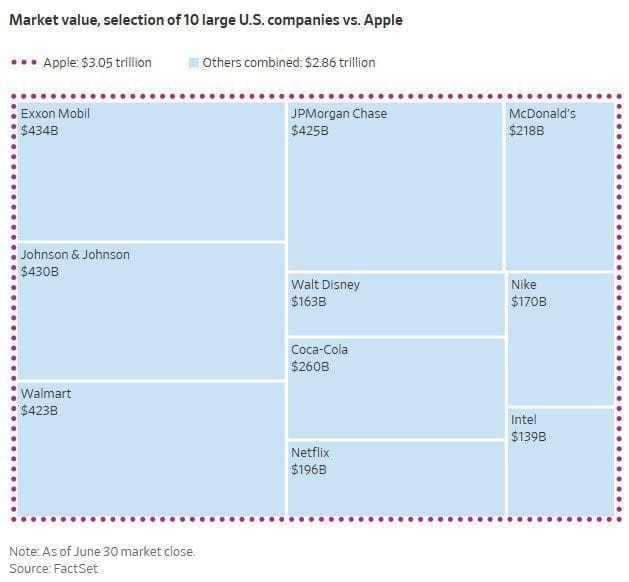

Apple, which was founded in a California garage in 1976 as a brash computer company, is now worth approximately twice as much as its longtime rival Google and seven times as much as Exxon Mobil, which for many years dominated the global markets.

The tech behemoth has become ingrained in the lives of consumers and a pillar holding for investors, whose faith in its dominance is unwavering despite the fact that heightened Western tensions with China continue to highlight its heavy reliance on Chinese manufacturing.

The Cupertino, California, company’s stock has been on a tear this year, fueled by new demand from emerging markets such as India and the release of a $3,499 headset that combines virtual reality with the ability to position digital content in the real world. Tim Cook, chief executive officer, termed it a “spatial computing platform.”

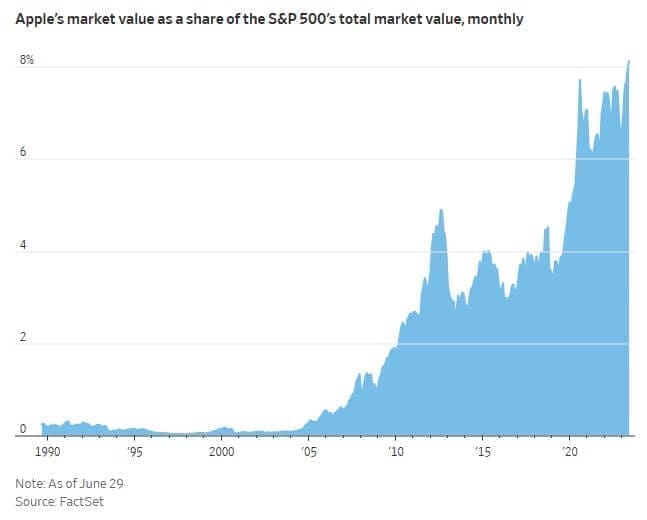

Since the beginning of the year, Apple’s stock price has increased by nearly 50%, outpacing the Nasdaq Composite Index’s development of roughly 30%. It took the company 42 years to achieve $1 trillion in 2018, and it will take two more years to reach $2 trillion in 2020. Getting to $3 trillion required nearly three additional years.

The company’s market capitalization momentarily surpassed $3 trillion during intraday trading in January 2022, but failed to close above the mark. The company was valued at $3.05 trillion as of Friday’s closing price of $193.97 per share, an increase of 2.3% on the day.

Apple is a safe haven for investors due to its “massive cash flow” and “huge customer base,” according to Dan Morgan, a senior portfolio manager at Synovus Trust who specializes in technology. Apple is one of Synovus Trust’s largest holdings. He added, “Investors purchase this company even when the economy is struggling.”

Apple’s current resilience is largely dependent on the iPhone, which accounts for roughly half of the company’s annual revenues. Since the iPhone’s introduction in 2007, the company has sold more than two billion devices. Apple’s decision to increase prices with the introduction of the Pro lineup in 2019 has increased overall sales, despite the fact that iPhone shipments are no longer growing rapidly.

Apple also continues to develop ancillary businesses around the iPhone, such as a high-yield savings account integrated into its Wallet app, that generate additional sales and keep its customers tethered to its ecosystem.

Apple’s recent performance has demonstrated the company’s resilience in the face of broader market challenges, allowing it to recover from the post-Covid slump much more rapidly than the majority of its major tech competitors.

The company has surpassed its longstanding competitor Microsoft. The Redmond, Washington-based software corporation reached $2 trillion in 2021, one year after Apple, and briefly surpassed Apple as the most valuable company in the world. Microsoft’s stock is up more than 40 percent so far this year, buoyed by its unusually close partnership with OpenAI, whose ChatGPT software has become one of the most closely monitored emerging technologies in years.

Microsoft is worth approximately $2.5 trillion.

Apple was struggling at the close of last year. In November, it issued a warning about supply-chain disruptions due to China’s Covid-19 restrictions, raising concerns about the company’s reliance on China for hardware production. Apple was unable to satisfy demand for its most premium iPhone 14 models prior to the holiday season. The company’s stock ended the year down roughly 30%.

This year, Apple reported consecutive quarters of declining revenue for only the third time in the past decade. In the second quarter that ended on April 1st, the company reported sales of $94.8 billion, a decrease of 3% compared to the same period last year. However, executives emphasized the company’s expanding iPhone business in emerging markets such as India, Indonesia, Latin America, and the Middle East, thereby bolstering investor confidence.

In a May interview, Apple’s chief financial officer Luca Maestri said, “The iPhone is truly a global product, and we’re doing well in emerging markets right now.” This has helped us mitigate some macroeconomic difficulties.

The Wall Street Journal previously reported that Apple has accelerated its efforts to relocate more of its supply chain from China to countries such as India and Vietnam in tandem with the growth of these developing markets.

However, this growth in emerging markets is unlikely to counterbalance the decline Apple is experiencing in more developed nations. UBS recently downgraded its stock rating from buy to neutral due to Apple’s continued sluggish growth in its developed markets, which is expected to continue. The United States, China, and Europe account for approximately 70% of iPhone demand for the quarter ending April 1.

UBS analyst David Vogt wrote in a recent investor note, “We do not believe the unit [total addressable market] and growth outside of the three largest markets is large enough to drive long-term, sustainable iPhone growth above mid-single digits.”

Apple’s stock declined after the downgrade, but rebounded along with the rest of the market as a result of the Federal Reserve’s decision to maintain interest rates despite data indicating continued economic strength despite previous rate hikes.

With the announcement of the Vision Pro earlier this month, Apple enters a crowded market with numerous competitors, including Meta Platforms’ Quest line. Apple fans, VR enthusiasts, and many analysts responded positively to demonstrations of Apple’s headset.

The Vision Pro “is a product that only Apple could have created at this time, given the inherent hardware and software integration required,” TD Cowen’s senior research analyst Krish Sankar wrote in a recent investor note.

The Vision Pro is not anticipated to generate significant financial returns in the near future. Its high price point makes mass market adoption unlikely, but Apple is reportedly working on less expensive future versions that will be released by 2025. Developers in the metaverse also anticipate that Apple’s entry will signal the beginning of widespread market adoption.

Apple’s entry into this market provides a potential window for the first stages of a future iPhone replacement.

Bernstein analyst Toni Sacconaghi wrote in a recent investor note, “We believe adoption of augmented reality will be a lengthy process and not financially material to Apple in the near term.”