The government trial focuses on the search contract as concerns rise over the iPhone 15 cycle and its future in China.

Google is the Silicon Valley business most identified with “moonshots,” but Apple’s red down pointing triangle may someday require one of its own replacing Google.

The two have long been adversaries, especially given that their respective Android and iOS platforms dominate the global mobile operating system industry. They are, however, linked at the hip by a lucrative partnership in which Google pays Apple billions of dollars every year to be the default search choice on the company’s Safari internet browser. This provides Google with preferential access to Apple’s iOS customers while also providing Apple with a consistent and high-margin revenue stream for its important services industry, which currently amounts for 21% of its sales and 35% of its gross profits.

Neither firm has ever been enthusiastic about discussing the agreement in public. Now, the federal government’s antitrust trial against Google, which began last month, has shed some light on the transaction, compelling officials from both firms to testify to defend the practice. It also summoned Microsoft drop; red down pointing triangle Chief Executive Satya Nadella to the stand, who criticized the structure as a “vicious cycle” that handicaps Google’s future competitors during testimony last week. They include Microsoft’s Bing search engine, for which Nadella claims the business attempted for years to strike an agreement with Apple to become the default search engine.

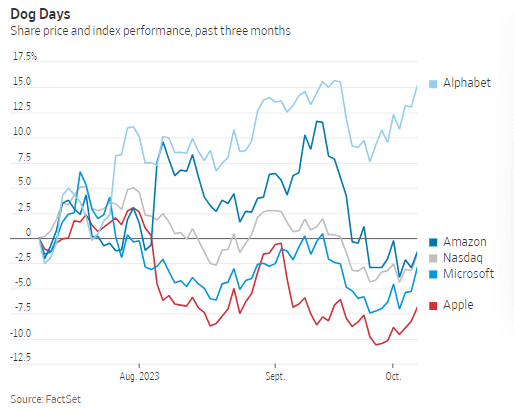

The trial is still a long way from being over, and even a positive verdict for Google would almost certainly spawn appeals, potentially leaving the subject unresolved for years. However, it has arrived at an unfortunate moment for Apple, which is concerned about its newest iPhone cycle as well as its future operations in China. Apple’s stock price has dropped more than 7% in the previous three months, making it the poorest performer among Big Tech peers. The aworld’s most valuable firm has lost more than $220 billion in market value as a result.

In the short term, answers to questions concerning iPhone 15 sales and China will be provided. Apple’s fiscal fourth-quarter report, due Nov. 2, will contain a week’s worth of sales of the newer iPhones, which might show whether concerns about the new Pro models overheating had any influence on actual sales. It will also provide Apple with an opportunity to address mounting concerns about its business in China, where authorities are tightening down on American tech companies and a once-hampered local competitor, Huawei, appears to be making a comeback.

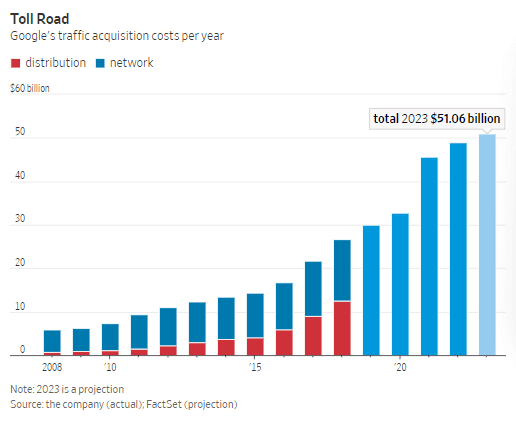

The eventual destiny of the company’s arrangement with Google will almost certainly remain a mystery. And they are pricey inquiries: Google parent Alphabet GOOG decrease; red down pointing triangle currently spends roughly $50 billion per year on traffic acquisition expenditures, which are payments made to partners and websites that generate traffic for the company’s search engine. Apple has always been expected to get the lion’s share of a subset of those payments, Google’s payments to distribution partners, which reached $12.6 billion in 2018 when Google ceased disclosing specifics about its TAC payments. TAC payments to distribution partners grew by 34% yearly on average over the five-year period ending in 2018, compared to 9% increase for TAC payments to network partners—sites that use Google’s ad technologies and send traffic to its search engine.

Neither company has publicly divulged the exact amount of money paid to Apple. During opening statements, a government lawyer stated that the amount is more than $10 billion each year, prompting complaints from both corporations in a public trial that has been obliged to keep most nonpublic material hidden. Goldman Sachs analyst Eric Sheridan projected a figure of $16 billion to $17 billion each year in a report last week.

This would amount to around 20% of Apple’s estimated services revenue for the fiscal year ending in September. Its removal would have a greater impact on the company’s profitability because it has very little extra cost and hence fetches significantly better margins than other services components such as TV+ and Apple Music. According to Morgan Stanley analysts, losing all of Google’s payments would reduce Apple’s per-share earnings by around 15% in fiscal 2025, or 10% if the loss was restricted to the United States.

Apple must carefully examine its alternatives. Simply substituting Google’s payments with an equal-sized income stream from a business like Microsoft may be difficult if the trial finds that such payments limit overall competition. Apple has apparently been working on its own in-house search engine alternative for years, and the Google experiment might give that effort a boost.

That, however, would not be easy: Google has had a 25-year head start in refining its technology, and Apple’s recent blunders in some of its in-house chip initiatives demonstrate that even vast dollars can’t always close a competitive gap. However, Apple has billions of reasons to aim for the stars.