Chipmaker said its programmable chip unit for defense and telecoms will ultimately go public.

As Chief Executive Pat Gelsinger presses through with the company’s far-reaching and costly recovery plan, Intel INTC drop; red down pointing triangle aims to sell a share in a subsidiary that develops programmable chips extensively used in the defense and telecommunications industries.

The semiconductor behemoth said that the subsidiary, which manufactures chips that can be reprogrammed after they are made, will begin operating as a standalone corporation on January 1, with an aim to offer shares in an IPO within two to three years.

According to the corporation, it may also look for private investment in the business, in which Intel will keep a controlling ownership. According to Gelsinger, the decision would allow the corporation to focus more on its core business and long-term strategy, while also granting the unit freedom to help it expand its market share.

Intel purchased the company in 2015 when it paid $16.7 billion for Altera. The unit generated $484 million in revenue in the fourth quarter of 2021, the last time its numbers were disclosed separately, accounting for around 2.4% of the company’s overall revenues.

In line with the separation, Intel appointed Sandra Rivera as CEO of the programmable-chip segment and Shannon Poulin as COO. Rivera will continue to oversee Intel’s data center and artificial intelligence groups until a replacement is found.

Rivera stated during an investor call that the unit will focus on fast-growing areas for programmable chips, such as the automotive, aerospace, industrial, and military markets, under her supervision. According to her, the market for the chips was valued at over $8 billion this year and was expected to expand to more than $11 billion by 2027.

Gelsinger has vowed to cut expenditures by up to $10 billion by the end of 2025 to help offset the strategy’s costs.

He also reached an agreement with Brookfield Asset Management to pay for almost half the cost of new chip-making facilities in Arizona, the first in what might be a series of such agreements. In addition, he has divested or sold stakes in a number of companies, including self-driving vehicle subsidiary Mobileye Global, which will go public in 2022.

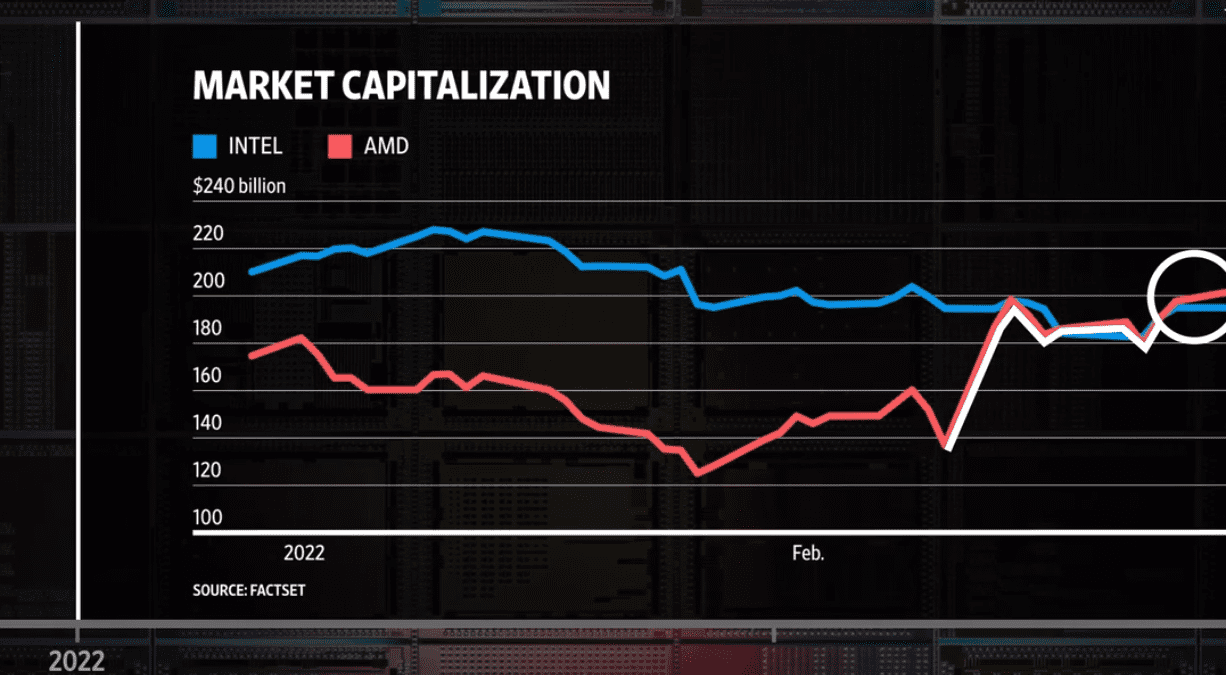

The split of the programmable-chip business leads Intel in a different way than competitor Advanced Micro Devices, which paid $35 billion for programmable-chip manufacturer Xilinx in 2022.

Under Gelsinger, Intel has suffered its steepest-ever losses, but it has also showed indications of recovery in recent months, aided by a resurgence in the personal-computer industry and demand from the artificial intelligence boom.

In its second quarter, the corporation earned $1.5 billion, surpassing projections of a loss. Gelsinger recently stated that the firm was on course for a successful third quarter, and that it had received a big payment from a client to use its most advanced future chip-making technology as part of a contract chip-making business, which is critical to the turnaround.