Nvidia and AMD stock fell in premarket trading today after The Wall Street Journal reported that the Biden administration is considering additional restrictions on the sale of artificial intelligence-related chips to China.

The discussions highlight the White House’s concerns about falling behind in the race to dominate artificial intelligence and the possibility for Beijing to utilise the technology in military applications — and they suggest that it is prepared to tighten trade restrictions to remain ahead.

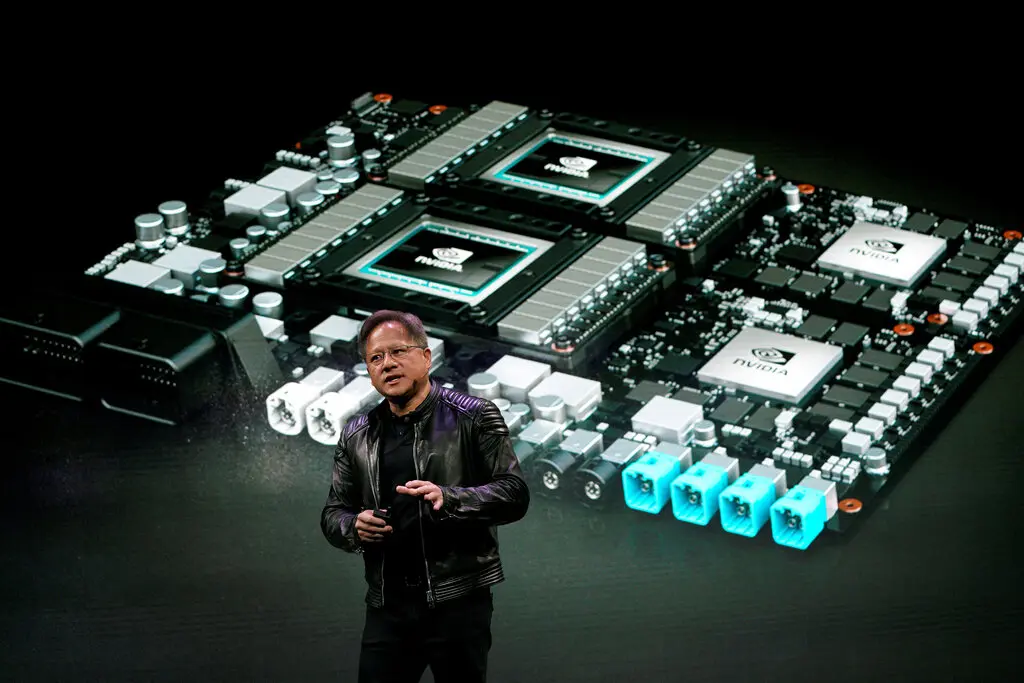

Any such step would reduce sales of some lower-end artificial intelligence devices, after the Biden administration’s restriction of exports of the most advanced semiconductors last year, according to The Journal. This would include Nvidia’s A800 processors, which were designed particularly to meet previous Commerce Department constraints on processing capability. To be sold to Chinese enterprises, such chips may now require a licence.

The story has dragged down the prices of firms that might be affected, despite the fact that a final decision is unlikely until next month, when Treasury Secretary Janet Yellen returns from a trip to China. Nvidia shares, which have more than quadrupled this year due to investor anticipation for artificial intelligence, were down more than 3.1 percent as of 7 a.m. Eastern on the story, while AMD shares were down 3.5 percent.

Stocks of Chinese technology companies sank as well: Chengdu Information Technology of the Chinese Academy of Sciences lost nearly 12% today, while Inspur Electronic Information Industry fell 10%.

The purpose is to stymie China’s artificial intelligence growth in the interest of national security. The White House has frequently stated that AI is a critical technology for a wide range of uses, from military weaponry to cybersecurity, and it has pushed allies, like Japan and the Netherlands, to limit shipments to Beijing as well.

As a result, corporate executives are forced to choose between supporting measures to safeguard American interests and preserving their enterprises. (For example, China accounts for around 20% of Nvidia’s sales.) “I can’t emphasise it enough: If we treat every economic interaction as a risk, we will lose focus on those that truly pose a threat,” said Suzanne Clark, president of the United States Chamber of Commerce, in a speech last month.

It is uncertain how Beijing would respond, but the possibility of additional escalation in the US-China trade conflict exists. The Chinese government barred local enterprises that handle sensitive information from purchasing Micron chips last month, citing “relatively serious cybersecurity problems.”

According to The Wall Street Journal, a top Biden administration official conveyed concerns to Sequoia last year about investments made by the venture capital firm’s China arm in local start-ups that may pose national security dangers. Sequoia announced a proposal last month to separate its Chinese and Indian investment operations.

Jeffrey Epstein died as a result of jail incompetence, according to federal investigators. An inquiry by the Justice Department discovered that excessive carelessness and malfeasance at a now-closed Manhattan jail caused the convicted sex offender and discredited billionaire to commit suicide. The study found no evidence to refute previous determinations that Epstein committed suicide.

UBS is rumoured to be planning large layoffs at Credit Suisse. According to Bloomberg, the Swiss bank is planning to let off more than half of its former rival’s 45,000 employees beginning next month. UBS completed its government-brokered acquisition of Credit Suisse earlier this month, and a cull would be part of the surviving bank’s $6 billion cost-cutting initiative.

According to reports, Fidelity intends to launch a Bitcoin E.T.F. According to The Block, the asset management behemoth will seek clearance for a spot Bitcoin exchange-traded fund. That would make it the latest Wall Street titan to advocate for a mainstream cryptocurrency fund in the expectation that the S.E.C. will ultimately authorise such endeavours.

A Russian commander was aware of Yevgeny Prigozhin’s revolt intentions in advance. American intelligence is currently investigating whether Gen. Sergei Surovikin, the former senior Russian commander in Ukraine, assisted the Wagner Group leader in planning his violent insurgency.

US officials are increasing their monitoring of transactions. Antitrust regulators have recommended requiring significantly more information from corporations contemplating a merger, including disclosure of government subsidies received from China, Iran, and Russia. If the proposed new restrictions are implemented, they might cause transaction completion to be delayed by several months and result in extra paperwork.

The threat of inflation looms over central bankers.

Investors on both sides of the Atlantic will tune in at 8:30 a.m. Eastern today for the main event from the European Central Bank’s summer meeting in Portugal: a discussion between E.C.B. President Christine Lagarde, Fed Chair Jay Powell, Bank of England Governor Andrew Bailey, and Bank of Japan Governor Kazuo Ueda.

The world’s top monetary officials have gathered in Sintra, a hilltop resort town on the Portuguese coast, at a challenging moment for the global economy, as a cost-of-living crisis affects North America, Europe, and beyond.

The major question is whether central bankers can lead their economies out of a long-term slump while also fighting inflation.

Analysts are split. HSBC forecast yesterday that the United States would enter a recession in the fourth quarter, followed by Europe the following year. According to Goldman Sachs experts, the chances of a US recession are 35 percent, but the Fed faces a “hard path” to prevent a so-called hard landing.

The majority of the panellists have adopted an aggressive interest-rate strategy. Since December 2021, they have hiked rates 31 times in total. The Bank of England tops the group with 13 rate hikes (which have had little influence on inflation), followed by the Fed (10), the E.C.B. (eight), and Japan (zero – Japan’s inflation remains low, and the central bank hasn’t moved rates since 2016).

More hikes are on the way in the United States, Europe, and the United Kingdom. The futures market is pricing in at least one more Fed rate hike this year, most likely in July. Markets believe the European Central Bank and the Bank of England have substantially more work to do to bring down persistently high inflation.

Lagarde struck a hawkish tone Monday, warning that European inflation had become entrenched at all levels of the economy. To further reduce prices, she stated that the central bank “will have to bring rates to sufficiently restrictive levels and keep them there for as long as necessary.”

Today, expect more tough language from the Fed. The Fed must “communicate a commitment to fight inflation at any cost,” according to Michael Gapen, chief US economist at Bank of America, in an investor note this week.

“They don’t want a normal person or a normal business.” They want something out of the norm. You are not born exceptional.”

Spencer Shulem, CEO of BuildBetter, explains why he utilises LSD on occasion. He claims the substance increases his inventiveness and attention, giving him an advantage with venture investors searching for great start-up leaders in whom to invest.

What happened during the PGA Tour meeting?

Being a PGA Tour director was never meant to be a particularly controversial position. However, yesterday’s board meeting in Dearborn, Mich., was more important than most. It was the first since the PGA Tour tentatively agreed to a merger with the Saudi-backed LIV Golf league on June 6, an agreement that most of its directors, including its player members, were unaware of prior to its announcement.

The board had been holed up on the first floor of the Henry Hotel for hours. In attendance were Wachtell’s Edward Herlihy, the board’s chair and one of the deal’s primary negotiators; Mary Meeker of the investment company Bond; and Randall Stephenson, the former CEO of AT&T. Rory McIlroy, Patrick Cantlay, Charley Hoffman, Peter Malnati, and Webb Simpson were among the five player representatives on the board.

Robert Gibbs, the former White House spokesperson who was recently engaged to defend the PGA Tour as it faces a mountain of scrutiny from Washington over the potential arrangement, was also sighted.

The board said that discussions had reached a “new phase.” A five-page framework agreement issued this week indicated that few specifics had been agreed upon, causing some attorneys to compare the potential sale to a litigation settlement rather than an M&A transaction. However, following the meeting, the PGA Tour stated that achieving a final deal was “in the best interests of our players, fans, sponsors, partners, and the game overall.”

Any final agreement would need to be approved by the board. Herlihy and James Dunne, an experienced dealmaker who was also involved in the negotiations, are anticipated to endorse the deal, and McIlroy has offered his backing unwillingly. However, the majority of the other players on the board have yet to show their hand.

Allen & Co., the tour’s financiers, detailed their approach for valuing the business, which includes television and digital rights as well as sponsorship partnerships, but did not provide exact figures.