The world’s economies are shaky, but that hasn’t stopped travelers from vying for airline tickets.

According to aviation executives gathered at the Paris Air Show this week, the ferocious post-pandemic demand for air travel shows no symptoms of abating soon. They cite recent large aircraft orders, such as the Indian low-cost airline IndiGo’s record-breaking 500-jet agreement last week.

“There is an economic slowdown, but airlines are not seeing a decrease in bookings,” said Guillaume Faury, chief executive officer of Airbus, the world’s largest commercial jet manufacturer. “And they continue to see a very strong demand with high prices.”

This demand has clashed with the industry’s limited capacity to rapidly increase airplane production. Airbus and its competitor Boeing have experienced shortages of components such as engines, processors, and laborers. Both companies have extensive order backlogs.

Recognizing these limitations, airlines are scrambling to reserve aircraft even though they won’t be delivered for years.

In an interview at the company’s temporary air-show office near the runway of a small airfield northeast of Paris, Faury stated, “We cannot produce planes fast enough to meet the demand.” A modern aircraft order is “a reservation of slots in the backlog, in fact for a scarce resource,” he explained.

For example, IndiGo’s jets are not scheduled to be delivered until at least 2030.

In a press conference prior to the air show, the CEO of Boeing, David Calhoun, stated that he does not expect his company’s supply chain to stabilize until the end of next year.

“Why are individuals now ordering aircraft into the 1930s? Because they perceive the same thing, said Calhoun.

The aviation industry is notorious for its boom-and-bust cycles, but the recent cycle has been exceptional. Throughout portions of the pandemic, air travel nearly came to a halt.

Last year, when travel restrictions began to be lifted, airlines were surprised by the pent-up demand. Airports were overcrowded during the summer of 2017. It was difficult for airlines to rehire personnel and return aircraft to service.

In recent months, numerous carriers have transitioned from recovery to expansion mode. IndiGo placed a record order for 500 Airbus A320-family narrow-body aircraft to expand its domestic network and international service. Air India’s February order for 470 planes, split between Airbus and Boeing, was momentarily the largest ever placed.

Two Saudi Arabian airlines announced earlier this year that they would purchase nearly eighty Boeing 787 Dreamliners, the company’s popular wide-body aircraft, as part of a larger plan to increase travel to the oil-rich kingdom.

United Airlines ordered 100 Boeing wide-bodies late last year. Ryanair, Europe’s largest airline, placed an order for up to 300 Boeing 737 MAXs last month.

At a press conference held in Paris prior to the show, Boeing’s commercial chief Stan Deal stated, “We’ve received some enormous orders.” The market for wide-body aircraft is picking up, and there is a great deal of demand.

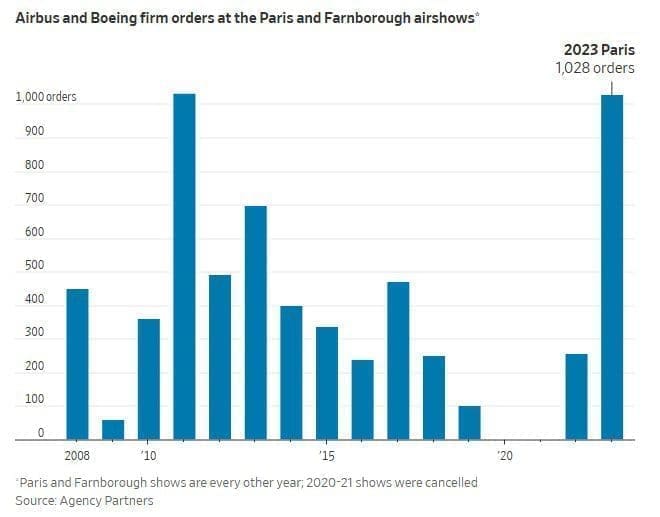

Airlines and aircraft lessors have ordered 1,429 Airbus and Boeing jets so far this year, including the agreements announced this week. That is already more than the total number of orders received in 2019 for the entire year. The number of confirmed orders at this year’s air show was the greatest since 2011, according to the aerospace research firm Agency Partners.

The 737 MAX and the A320 compete in the most lucrative segment of the commercial aviation market. These narrow-bodies typically carry fewer passengers on shorter flights. This market has recovered in anticipation of long-distance travel.

Just prior to the outbreak of the pandemic, Boeing experienced two fatal MAX accidents, resulting in a lengthy grounding and regulatory review that hampered its ability to compete with its European rival.

During the pandemic, Airbus pressed aggressively to deliver its planes to customers, many of whom no longer desired them. The European aircraft manufacturer also worked closely with suppliers to maintain production lines, anticipating a rapid recovery in demand.

This wager paid off, allowing Airbus to significantly influence one of the world’s most renowned business duopolies. It surpassed Boeing in both annual deliveries and total backlog to become the largest aircraft manufacturer in 2019.

Boeing and Airbus had an approximately 50-50 split of global orders for single-aisle planes, the most profitable jets for both manufacturers, for many years. According to a Wall Street Journal analysis of both companies’ orders and backlogs, including announcements made at the show this week, Airbus currently holds approximately 62% of this market.

In an interview, Faury stated that Airbus’ dominance in the narrow-body market is “likely to endure for a long time.”

He expects Airbus and Boeing to dominate the single-aisle market for the foreseeable future, but he is considering China’s new homegrown jetliner, the C919, seriously.

“It is possible that by the end of the decade they will have a significant market share in China,” Faury said. “How they will perform in comparison to the international market is difficult to predict at this time. But we are meek; we do not want to be overconfident about what the Chinese are capable of.”

Boeing’s Calhoun, who did not attend this year’s air show, has stated that regaining a 50% share of the narrow-body market is less essential than resolving its production issues.

At a pre-show press conference in South Carolina, where Boeing manufactures its wide-body 787 Dreamliner, he stated, “Most of the share losses that have occurred over the past four years, which are the ones that are really measurable, are because we couldn’t deliver airplanes.” “And we still have a hangover from not being able to deliver airplanes.”

Airbus was nearly sold out of its A320 narrow-body until the beginning of the next decade prior to IndiGo’s purchase. Airbus aims to reach a monthly production rate of 75 A320-family models by 2026, after reducing production to approximately 40 models per month during the pandemic. As it struggles to overcome supply-chain issues, it has repeatedly pushed back its output targets.

Boeing, meanwhile, aims to increase the monthly production rate of its rival 737 MAX jets from 31 to 38. The target should be reached “pretty soon,” according to Deal, the commercial chief at Boeing. The company intends to increase rates further but has not yet established a specific objective.

Boeing continues to dominate the market for larger aircraft.

“The wide-body industry is a unique circumstance. “The competition is fierce,” Faury said. “The backlogs are much shorter, capacity is available much earlier, and for those years there is a fierce competition between both sides as they attempt to win and dominate the campaigns.”