$55 Million Masterpiece Breaks Barriers with Landmark IPO, Inviting Public Investment in Art

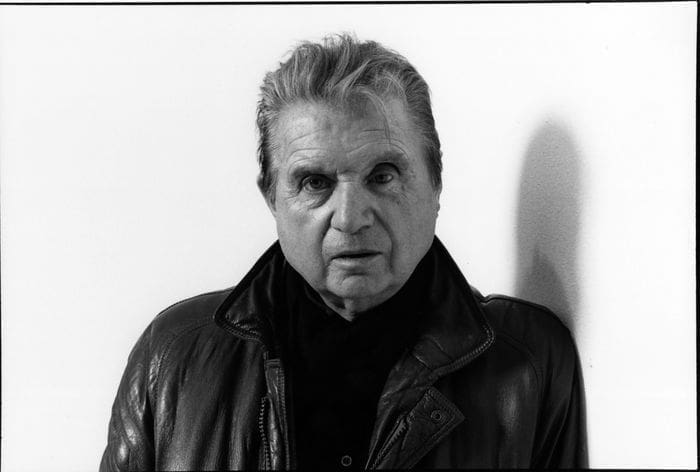

What would the late artist Francis Bacon think of everything? The upcoming debut of a portrait of his beloved on the stock market will give the average Joe access to the exclusive world of serious art collecting.

The catch is that the megarich may have already savored the greatest spoils.

Bacon’s “Three Studies for a Portrait of George Dyer,” painted shortly after the couple met in 1963, will be offered for sale by a company called Artex for approximately $55 million. Regular investors will be able to purchase and sell shares in a famous artwork on a stock exchange for the first time when the portrait is listed on a specially created art stock exchange based in Liechtenstein at a price of approximately $100 per share.

Trading is anticipated to commence in July. Instead of being hidden away in a freeport — high-security, low-tax warehouses where affluent collectors frequently store valuable works of art — the portrait will be displayed in a museum.

In the coming months, Artex has ambitious plans to sell $1 billion worth of paintings, each with its own IPO. Private collectors seeking a less expensive alternative to auction houses like Sotheby’s and Christie’s, which can charge up to 20% in commission, are believed to be the source of supply. Artex receives 3% of the IPO proceeds plus a small commission whenever shares of the Bacon portrait are traded.

It is one of several companies attempting to “democratize” highbrow art. In the near future, an additional innovation called aShareX will enable investors to band together and attempt to outbid affluent individual collectors at auctions of expensive paintings. Since its inception in 2017, the New York-based company Masterworks has provided investors with fractionalized art worth more than $700 million.

As an exchange, Artex will be governed by stricter regulations than a private art fund. The Bacon portrait will be publicly traded, and Artex will subsidize up to 3% of its daily market value to provide liquidity. This should make it a bit simpler to invest in and sell. Private art funds that lack a quick-sale option have had difficulty attracting retail investors.

The first artwork to be publicly listed raises the tantalizing possibility of a Bacon portrait takeover. According to Artex’s rules, if a billionaire collector or museum wishes to bid, they must offer a 20% premium over the average closing price of the shares over the previous 20 trading days. In contrast to a typical corporate acquisition, shareholders do not have the opportunity to vote on whether to accept the offer from a rival bidder.

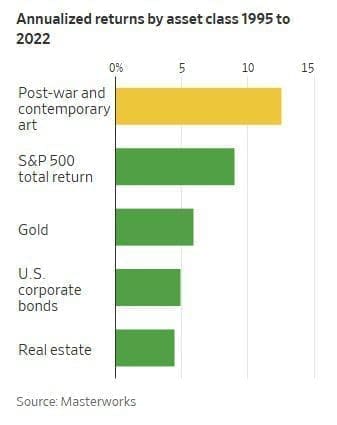

Paintings can be a profitable investment if purchasers are discerning. The returns on so-called “blue chip” art from renowned artists such as Francis Bacon and Mark Rothko have consistently outperformed traditional asset classes for decades. Between 1995 and 2022, the value of post-1945 masterpieces increased by 12.6% annually. Masterworks data reveals that during the same period, the S&P gained 9% and U.S. corporate bonds gained 4.9%.

The benefit of new “fractional” ownership models is that smaller investors who do not have millions of dollars to spend on a single painting can gain access to the very top of the art market, where the major money is made.

Similar to gold, high-end art has a firm reputation as a hedge against inflation. A pension fund for British Rail purchased a collection of paintings between 1974 and 1980 as a hedge against inflation in the United Kingdom. After retaining the works for roughly two decades, it yielded an annual return of just under 6%.

This time, however, regular investors are being allowed past the velvet rope at what is likely to be the tail end of an art bubble, when prices are already at a premium. Since the financial crisis, in particular, the market for masterpieces has been booming. According to the Art Basel & UBS Art Market 2023 report, the value of art sold at auction for $10 million or more increased by 700% between 2009 and 2022.

Extremely loose monetary policy is certainly a major cause: Citi analysts note that periods of falling or low real interest rates have occurred concurrently with soaring art prices. As central banks reverse course, it will be more difficult for art to generate headline-making returns.

Already, the art market’s peak is beginning to decline. According to analysis by art-market research firm ArtTactic, sales of works with a hammer price of more than $10 million totaled $621 million at New York’s crucial auction sales conducted in May, compared to $1.4 billion the previous year.

Typically, investors must retain artworks for an extended period of time to cover the costs of acquisition, storage, and sale. Over the course of a decade or more, the value of some collectors’ Bacon paintings has doubled or even tripled. In 2017, the anonymous private collector selling the Bacon portrait via Artex paid $52 million at auction for it. If the IPO is priced at the upper end of its guidance range of $53 million to $57 million, its value will have increased by 10% in six years.

Can a portrait of Francis Bacon truly safeguard investors from inflation? Due to their scarcity and widespread acclaim among the wealthiest collectors, the value of these paintings should rise over time. However, prospective prices for fine art may not increase as rapidly as they have in recent years.

As with other so-called investments of passion, art offers a high level of prestige and bragging rights but no income. Increasing interest rates may transfer the focus elsewhere.