Nvidia was valued at more than $1 trillion on Tuesday, making it the seventh U.S. company to achieve this status.

This year, shares of the chip manufacturer have risen 181%, fuelled by the growth in artificial intelligence, which CEO Jensen Huang recently described as ushering in “a new computing era.”

Tech giants and entrepreneurs invest billions of dollars in artificial intelligence technology. Nvidia is a beneficiary of these investments because its semiconductors are deemed indispensable for the development of the largest and most potent AI systems.

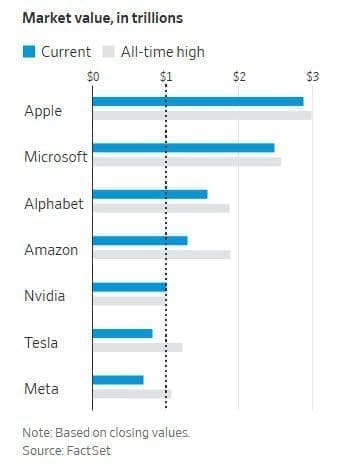

The chipmaker joins Apple, Microsoft, Google’s parent company Alphabet, and Amazon.com on the list of companies worth $1 trillion. Parent company of Facebook Meta Platforms and Tesla once surpassed this level, but their share prices have since declined.

Tuesday marked the first time that Nvidia’s closing price exceeded $1 trillion. The company’s market capitalization surpassed $1 trillion during intraday trading on May 30, but the stock closed the day below the $404.858 price required for a market cap of $1 trillion.

The stock closed Tuesday at $410.22, up 3.9% on the day, valuing Nvidia at approximately $1.01 trillion.

Huang and two other engineers founded Nvidia in 1993 at a Denny’s in the San Jose, California, area. The company’s initial focus was on improving computer graphics. In his early years, Huang encountered skepticism from venture capitalists who did not believe his target market, PC gaming, would ever take off.

During a talk at Stanford University, Huang stated, “The entertainment value of computer games was very obvious to me, and I could imagine how it could be a very large market and a large industry, but for many older people, that sensibility did not exist.”

Huang was proven correct in the late 1990s and early 2000s, when Nvidia became a dominant processor manufacturer for videogamers who valued high-resolution, fluid graphics.

The Santa Clara, California corporation designed chips but never manufactured them. Nvidia relies on contract semiconductor manufacturers, including Taiwan Semiconductor Manufacturing and Samsung Electronics, to manufacture its chips. The chips are typically among the most sophisticated processors in the semiconductor industry.

Huang expanded the use of Nvidia’s processors beyond computer graphics about sixteen years ago, marking a turning point for the company. Scientists and engineers began employing them for physics simulations and, eventually, for artificial intelligence calculations, at which they proved particularly adept.

In recent years, the company has expanded into new areas, such as supplying chips for self-driving vehicles that rely heavily on artificial intelligence.

Since then, Nvidia’s AI-focused data center operation has eclipsed the gaming division as the company’s primary revenue generator. The AI calculations that underpin sophisticated language-generation systems typically occur in the background, in vast server farms equipped with Nvidia processors.

Nvidia stated on May 24 that it anticipated record-breaking sales of approximately $11 billion for the current fiscal quarter. The figure exceeded analysts’ expectations, resulting in a 24 percent increase in the company’s stock price the following day.

Huang stated at a recent conference in Taiwan that Nvidia’s graphics processors are at the center of a new era of computation tailored to the development of artificial intelligence. According to Huang, this era signifies a departure from an older model that heavily relied on the central processing unit as the computational powerhouse.

“In every single era of computing, it was possible to do things that were previously impossible,” he said. “And artificial intelligence most certainly qualifies.”

Graphics processors specialize in determining the appearance of each pixel on your screen at any given time. Because displays typically contain thousands of pixels, the chips must be capable of performing multiple calculations simultaneously.

This strategy differs from the typical central processing unit, which is designed to perform fewer calculations simultaneously but as quickly as feasible.

Nvidia’s recent stock increase is attributable to the surge in interest in artificial intelligence (AI) tools that generate intelligent responses to basic queries, such as OpenAI’s ChatGPT, since late last year. Analysts anticipate that Nvidia’s chip demand will continue to rise as a result of the influx of investment in these systems.

“ChatGPT was an eye-opening event,” said Stacy Rasgon, an analyst for Bernstein Research in the semiconductor industry. “It was the first time that the average person on the street could reach out and touch this and see that it is useful and can be used to do things.”

Investors are increasingly enthusiastic about the profit potential of the AI revolution. Their enthusiasm has helped the Nasdaq Composite Index outperform the broader stock market and contributed to significant gains for many of the world’s largest technology companies this year.

Historically, Nvidia’s chief competitor has been Advanced Micro Devices, a manufacturer of high-end computer graphics processors. AMD also manufactures chips for artificial intelligence, and on Tuesday it unveiled a new iteration of processors to compete more effectively with Nvidia.

Intel is another competitor. It produces its own graphics processors for AI, has enhanced its central processors for AI, and manufactures additional chips designed to perform AI computations.

In addition, a multitude of firms produce AI chips. And for years, large cloud-computing companies such as Google and Amazon.com have manufactured their own AI processors.

Nvidia was the first major chip manufacturer to pursue artificial intelligence, providing it a significant advantage over its competitors. Huang has stated that he has been “constantly aware of competition.”