Nvidia, Intel, and Qualcomm are fighting to defend their companies from further restrictions on the selling of semiconductor technology to China.

A year after taking its first significant move toward blocking the sale of semiconductors to China, the Biden administration has begun writing new restrictions aimed at denying Beijing crucial technology for modern weapons.

However, its progress has stalled in recent months as American chip companies have responded with a stern warning: cutting shipments to China would cripple their operations and disrupt the administration’s goal to create new semiconductor plants in the United States.

Since July, three of the world’s major chipmakers, Nvidia, Intel, and Qualcomm, have argued that tightening down on China will have unexpected repercussions. According to interviews with two dozen officials from the government, industry, and policy organizations, they have challenged the White House’s national security wisdom in meetings with officials such as Secretary of State Antony J. Blinken and Commerce Secretary Gina M. Raimondo, wooed think tanks, and urged leaders across Washington to reconsider additional chip controls.

Companies have cautioned that a U.S. withdrawal may hasten China’s establishment of an independent chip sector, opening the path for a world dominated by Chinese-designed chips rather than American-designed chips.

“What you risk is fostering the development of an ecosystem led by competitors,” said Tim Teter, Nvidia’s chief counsel and a key figure in the lobbying push. “And that can have a very negative effect on the U.S. leadership in semiconductors, advanced technology and A.I.”

According to two people familiar with the process, the campaign has contributed to the postponement of additional limitations and has restricted the range of modifications that the government may undertake. However, the Commerce Department and the National Security Council, which are in charge of the rule-making process, claimed they were committed to protecting sensitive technology.

Requests for response from Mr. Gallagher’s office were not returned.

The companies’ warnings speak to the tension between national security concerns and commercial interests, highlighting an unavoidable quandary for the Biden administration: the United States’ and China’s economic interdependence, which dates back decades, means that any action by Washington to confront Beijing risks causing harm at home.

China accounts for almost one-third of the worldwide semiconductor business and generates more than $50 billion in yearly sales for Nvidia, Intel, and Qualcomm combined. The businesses have warned that losing that money might result in reductions in technological research, job creation, and investment on semiconductor plants in Arizona, Ohio, and New York.

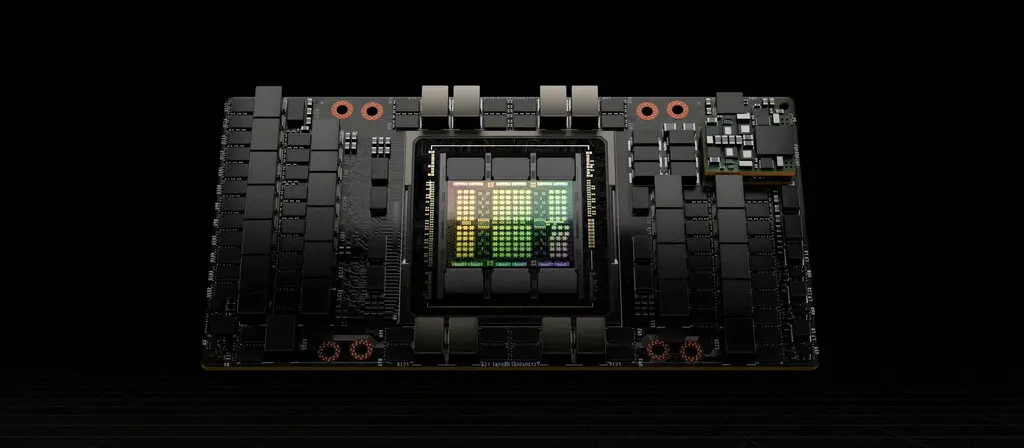

Last year, the sector implicitly accepted the limits set by the government on October 7, shortly after President Biden signed the CHIPS Act. Companies adapted their operations. Nvidia created a Chinese version of their hallmark artificial intelligence chip, the H100, by decreasing its performance power below the maximum levels permitted by the guidelines.

However, the costs of the limitations grew. Micron Technology, an American memory chip firm, has had several of its products banned in China. National security specialists in Washington detected flaws in the limitations. And government officials began to wonder whether Nvidia’s chip for China violated the spirit of the guidelines.

In July, industry leaders were frightened by reports that the administration was on the verge of broadening its powers by, among other things, prohibiting Nvidia from selling the A.I. chip it built for Chinese usage. They were concerned that the administration might target Nvidia and Intel’s sales to subsidiaries of Inspur Group, a Chinese conglomerate with military ties, as well as Qualcomm’s sale of 4G mobile chips to the Chinese telecom giant Huawei, which it had a special permit to supply, according to two industry executives.

That month, three CEOs — Intel’s Patrick Gelsinger, Nvidia’s Jensen Huang, and Qualcomm’s Cristiano Amon — came to Washington to meet with the government.

Mr. Teter, Nvidia’s general counsel, stated that the corporation had never objected to Mr. Allen’s work. “We’re confident he’s presenting the best research he can, and we completely respect that,” she added.

In addition to meeting with the White House, the CEOs also met with Eric Schmidt, former CEO and Chairman of Google.

Mr. Schmidt has emerged as a Washington power figure after standing down as Google’s executive chairman in 2018, sitting on two Defense Department advisory committees and supporting his own think tank, the Special Competitive Studies Project. He has also advocated for restricting China’s access to American-designed semiconductors.

Mr. Gelsinger, Mr. Amon, and Mr. Huang met with Mr. Schmidt in mid-July to discuss the risks of chip restrictions, according to two individuals informed on the session. Mr. Schmidt’s representatives declined to comment.

Mr. Schmidt’s think tank asked Mr. Gelsinger and Mr. Huang to offer fireside talks at a national security and technology conference in Washington last month. Neither executive responded to inquiries concerning semiconductor limits or China.